Why do you need an emergency fund?

Because sh** happens and it can be expensive.

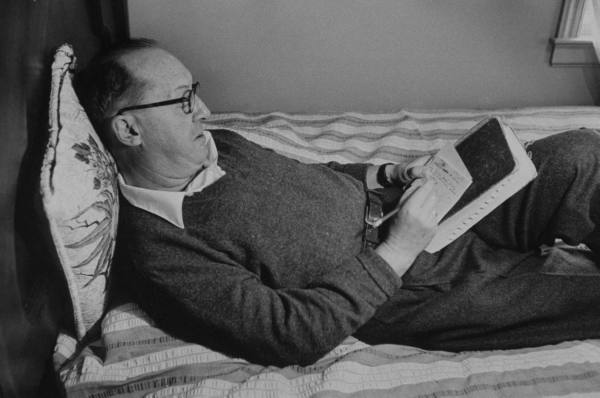

Kids end up in the emergency room; your car goes kaput in the middle of New Mexico; your water heater springs a leak. We’ve all experienced these setbacks and their accompanying bills. Some of us have suffered the misfortune of getting laid off and being without a source of income for months. Many people don’t plan for emergencies in their monthly budget, so when the poop hits the fan, they’re forced to take on expensive credit card debt to cover the bills.

An emergency fund is insurance for you and your family. Having cash on hand to cover unexpected expenses has two big benefits. First, it gives you peace of mind. Instead of wringing your hands worrying about where you’re going to come up with the money to cover an emergency expense, you simply transfer money from your emergency fund to your checking account. Crisis averted.

Second, and more importantly, it helps you get ahead financially. Instead of taking on more debt by using your credit card for emergencies, an emergency savings fund will prevent you from digging yourself deeper into a hole.

An added benefit of an emergency fund is the feeling of pride that self-sufficiency gives a man. You can’t beat it.

Where to Stash Your Emergency Fund

Your emergency fund should be liquid and easily accessible. While it may be tempting to get a higher interest rate by putting your money in a CD or mutual fund, those savings devices make getting to your money difficult when you need it most. Instead, opt for a boring old savings or checking account with a local or online bank.

Your emergency fund should be liquid and easily accessible. While it may be tempting to get a higher interest rate by putting your money in a CD or mutual fund, those savings devices make getting to your money difficult when you need it most. Instead, opt for a boring old savings or checking account with a local or online bank.

Local banks. Local banks are great places to stash your emergency fund because you probably already do business with them. Just visit a branch and ask to open a separate savings account for your emergency fund. Depositing money into your account is easy because you can do the transaction in person. Ensure that your savings account is connected with a checking account, so you can easily transfer emergency money to your checking account when you need to spend it. The downside with brick and mortar banks is that the interest rate isn’t that great, but this isn’t a big deal because we’re not trying to get rich on the interest from our emergency fund.

Online banks. Online banks are a great place to keep your emergency fund because they typically have higher interest rates and lower costs and fees than the brick and mortar variety. A few years ago online banks like Ally had crazy monthly interest rates between 2%-4%, but they’ve since gone down to about 0.8-1%. Not fantastic, but still better than most traditional banks.

The biggest drawback with online banking is the inconvenience. You can’t go into a branch to deposit money; to fund your online account, you have to connect it to a traditional bank. And if you don’t have a debit card for your online account, getting to your money can be difficult. You’ll have to request a transfer from your online account to your traditional account and wait three to four business days for the transaction to clear.

Personally, I find this inconvenience a helpful firewall that ensures I don’t cheat and dip into my emergency fund for things that aren’t really emergencies. But just do what works for you.

Should I keep some cash under the mattress? It’s not a bad idea to keep part of your emergency fund hidden somewhere in your house. Natural disasters and zombie apocalypses can knock out banks and ATM machines for days and even weeks, cutting you off from your money. $300-$400 in cash is a good amount to have on hand. Hide it in your mattress, store it in a fireproof safe, or even keep it in your bug out bag. For style points, keep your emergency cash in a secret book safe.

How Much Do I Need in My Emergency Fund?

When Kate and I were working on paying off our debt, we followed Dave Ramsey’s Total Money Makeover. I know Dave has his critics, but his plan worked for us. Dave believes you should create a $1,000 emergency fund before you start working on paying off your debt. That way, you can use this small cushion for emergency expenses, instead of adding to your debt by using your credit card.

After paying off your debt, you begin building an emergency fund with enough money to cover three to six months of basic living expenses. We’re talking the bare necessities here. That’s about $5,000-$25,000 for most folks. This fund is designed to cover most big emergencies and provide enough money to live on in case you lose your job.

Emergency Fund Goal #1: $1,000 Fast!

Our $1,000 emergency fund came in handy several times during our debt repayment process. When I was in law school we had a few emergency car repairs that came up. We also had to make a couple of unexpected visits to the hospital. Instead of having to use credit cards, we were able to pay for these expenses with cash from our emergency fund. No new debt!

The goal is to get this $1,000 emergency account funded as quickly as possible. You also want to ensure that your account constantly has $1,000 in it, so whenever you use funds from your emergency account, you’ll want to replenish your fund as soon as possible.

“Alright,” you might be thinking, “This sounds good in theory, but how am I going to scrape together $1K when I’m barely making ends meet as it is?”

I know pulling together $1,000 can seem daunting. I’ve been there. We built our emergency fund when I was in law school. Kate and I were both working part-time, but we were barely getting by. Despite that, we were able to fund our $1,000 emergency stash in just two months. The key to creating a $1,000 emergency fund in a short amount of time is 1) increasing your income quickly and 2) cutting big expenses. In short, hustle and sacrifice.

There are a myriad of ways to cut expenses and increase your income. Listing them all would be a post in and of itself. So here are a few ways that helped Kate and I build our $1,000 emergency fund. I’d love to read what worked for you.

1. Have a yard sale. Taking part in a garage sale went a long way in helping us quickly reach our $1,000 goal. We piggybacked on a yard sale Kate’s parents were having and gathered together all the crap we hadn’t used for months and the things people had given us when we got married that we’d never used, and sold it. At the end of the day, we netted about $250, and it went right into our emergency fund savings account. The other added bonus was our place was cleaner and tidier without the extra clutter lying around.

2. Sell your old DVDs, books, and video games on Amazon.com. I’m a book hound. I love reading books. When I was in high school and college, I would often go to the bookstore once a week to browse and buy a new book. Consequently, I had amassed quite a collection of them. So I signed up as a seller on Amazon.com and put up all my old books on the site that I knew I would never read again.

It’s amazing how fast those books went. Of course, selling on Amazon or eBay can be a pain. I spent many of my weekends packaging books and standing in the line at the post office, but the time commitment paid off. I earned about $100 from my Amazon.com sales blitz.

When Kate and I got serious about paying off our debt, I curbed my book-buying habit significantly and became a zealous patron of the library (I freaking love the library).

3. Cut the cable. Cable TV is expensive, and let’s be honest, most of the shows on there are crap. Cutting cable from your budget can easily give you an additional $20-$100 a month depending on how much you’re spending on your plan. And if you’re really desperate to watch some of your favorite tv shows, check out Hulu.com. You can watch many shows on there for free.

4. Get a second job/work odd jobs. I’m sure you’re a busy man. You probably already have a job and a family. Or maybe you’re going to school full-time and working a part-time job as well. But if you’re serious about getting your financial house in order, you’ll be willing to make the sacrifices necessary to reach your goal.

Don’t be picky about the kind of second jobs or odd work you take on. Personally, I’m of the opinion that no work is beneath you so long as it’s ethical and you give it your best. There are lots of flexible jobs you can work on the weekends or in the evenings. Deliver pizzas, bartend, wait tables, mow lawns, retail.

I have one friend who was doing the Dave Ramsey plan and wanted to fund his $1K emergency fund ASAP. So he bought some numbered stencils and some black and white spray paint, and knocked doors all weekend seeing if anybody wanted their address painted or repainted on the curb. He charged $10 for his services. In one weekend he made $400 and in one month he had his $1,000. This guy knows how to hustle.

5. Stay in on the weekends. For Kate and I, an average Friday night out could cost $20-$50. By limiting ourselves to just one night out a month, we were able to contribute $100 more a month to our fund. We just had to be a bit more creative with what we did on the weekends.

6. Shop for a better auto insurance rate. You’ve seen the commercials on TV claiming you can save a boat load of money by switching auto insurance plans. Take them up on their claim. Visit Progressive, State Farm, Geico, American Family, and esurance to see if you can save a $100 or more by switching to them.

If you like your auto insurance and don’t want to switch, give your insurance company a call to see if they have any safe driving or customer loyalty discounts. You also might ask if you can reduce your rate by paying a lump sum once or twice a year instead of paying every month. Kate and I saved about $100 making that switch.

7. If you’re married, share a car. This is something Kate I have done since we got hitched and still do today. Having only one car saves you big money on car insurance payments, oil changes, and other auto repairs and expenses. Sure, it can be inconvenient sometimes, but it’s also a good way to spend quality time together. Really! Those car rides to and from law school were the few times Kate and I had to just talk each day.

8. Collect and gather your loose change. I was surprised how much money we were able to add to our emergency fund simply by gathering all our loose change around the house and in the car. Sure, you’re not going to fully fund your $1K with just loose change, but I bet you can collect about $20-$40 in change in a month. Every little bit helps!

Here are 80 more ways to save money.

Emergency Fund Goal #2: 3-6 Months of Basic Living Expenses

An emergency fund with three to six months of living expenses socked away can seem like a hefty goal. If you’ve never had more than $1,000 in your bank account, saving $5,000 to $25,000 may seem downright impossible.

Don’t let the enormity of the goal overwhelm you. Small steps will eventually get you there. Imagine the feeling of supreme, manly confidence you’ll enjoy knowing you have enough money to weather the storms of life.

Where you keep your emergency fund shouldn’t change even though you’ll have more stashed away. We still want these funds to be liquid and easily accessible.

Kate and I are working on this goal right now. It will be awhile before we reach it, but we’ll get there. Two things that are helping us reach our goal:

1. Take what you were paying in debt each month and put it in your emergency fund. As soon as Kate and I paid off our debt, we started taking the money we had been paying each month towards debt reduction and putting it in our emergency fund. We’re already used to allocating this money in our budget, so it’s been easy to redirect it towards this new goal.

2. Make savings automatic. I don’t think much about funding my emergency fund because I’ve put our savings on auto-pilot. With the ING Direct automatic savings plan, I’m able to automatically transfer a set amount of money from my primary checking account to my emergency fund every month.