We’ve talked before about how in an age when checks have become uncommon (but still are used occasionally), the younger generation often doesn’t know how to write them, and offered a quick tutorial on the subject to remedy this knowledge gap.

But there’s also the flipside of the equation to discuss: what do you do when you’re the recipient of a check?

Like check writing, check cashing has become a lost life skill thanks to direct and digital payments. Yet try as you might to avoid receiving checks, you’re still likely to get them as a form of payment. For one thing, if you have an aunt named Gertrude who likes collecting Precious Moments figurines, you’re guaranteed to receive your $20 in Christmas money in the form of a check.

Today we walk you through exactly what to do to turn your check into useable funds.

First, Have a Bank Account

There are two things you can do to gain access to the value of a check: 1) cash it (turn it into cold, hard moola), or 2) deposit it right into a bank account.

If you don’t have a bank account, then your only option is #1, and it’s going to cost you.

When you cash a check, you give the bank or store (see below) the check and they give you money in return. A bank or store is taking a risk when they do this: they might give you the cash for the amount of the check, but once they try to clear it, if the check turns out to be bogus, they’re out that money they gave you.

To mitigate that risk, if you’re cashing a check at a bank that you don’t have an account with, they’ll charge you a service fee that could range from a flat fee of $10 to a percentage fee of 1% of the check’s amount. The same is true if you try to cash a check at a convenience store or Walmart. In short, if you don’t have a bank account, you’ll lose money when you cash a check.

However, if you cash your check with a bank that you do have an account with (and you have enough money in that account to cover the value of the check) then the bank won’t charge you a fee for getting that cash.

Plus, you’ll of course be able to simply deposit the check directly into the account (again, for free) instead of cashing it, which is the much more popular option. Once you deposit your check, the bank will make that money available in your account once it clears, which usually takes a day or two. If you put it into a checking account, you can then draw on it by using your debit card (or you can withdraw it from an ATM, should you turn out to need actual cash).

If you don’t have a savings and/or checking account, go to a bank today and open one up. It’s easy and will only take 20 minutes.

Let’s now dig into the different ways you can cash/deposit a check:

How to Cash/Deposit a Check With a Bank Teller

The old-school way to deal with a check is to walk into a bank branch and cash/deposit it with a human teller. It’s easy because you have a person there to help you with the process, and it’s the only way to instantly get actual cash for a check. But going into a bank is inconvenient (even if you use the drive-thru); especially if you get stuck in line behind an old dude depositing all his loose change into his savings account.

If you’re straight cashing the check, you’ll just need to hand it over with your photo ID (or sometimes just your your debit card + PIN).

If you’re depositing a check (or depositing just part of it and getting part of it in cash), follow these steps:

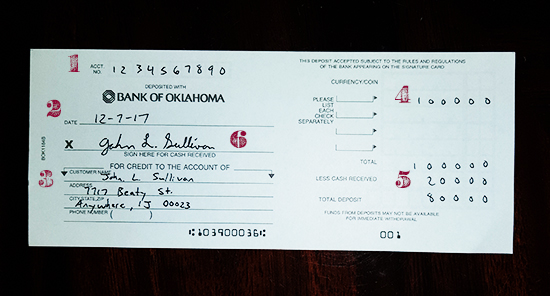

1. Fill out a deposit slip. You’ll find them in the bank’s lobby or near the teller’s counter. They all look pretty much the same everywhere. Here’s one from my bank, The Bank of Oklahoma:

Once you’ve got the deposit slip in hand, here’s how you fill it out:

- Fill in the account number of the account you’re depositing the check into.

- Write the date.

- Write your name and address.

- Fill in the amount of each check that you’re depositing.

- If you’re wanting some cash, fill in the amount of cash you want and subtract that from the total to get the total deposit.

- If you’re receiving cash, sign the slip on the signature line.

2. Endorse your check. Flip your check over and sign on the endorsement line. Do not endorse your check until right before you deposit it. If you sign it and then let it hang out for a bit beforehand, you run the risk of it getting stolen and then cashed by a thief. So play it safe and wait until you deposit the check to endorse it.

3. Give the check and deposit slip to the teller; if you’re asking for cash along with your deposit, the teller will likely ask for your photo ID, too. Once you’ve handed everything over to them (and they’ve handed back cash, if you asked for it) you’re done.

How to Deposit a Check With an ATM

If you want to avoid the lines at the bank or you need to deposit a check after the bank is closed, you can deposit your check (and even cash) via an ATM. Because so few people take advantage of ATM deposits, many banks have limited or completely gotten rid of the service, so call your bank to find out if they still offer it at their ATMs and, if so, at which ones.

Once you’ve located an appropriate ATM, here’s how to deposit your check into it:

1. Swipe your ATM card and enter your PIN.

2. Instead of selecting WITHDRAWAL, select DEPOSIT.

3. Get an envelope and fill out the requisite information.

4. Endorse the check and insert it into the envelope.

5. Place envelope in deposit compartment of ATM.

6. Select complete transaction on the screen.

7. Walk/drive away. But not before getting a Slurpee.

How to Deposit a Check With Your Phone

While depositing checks via an ATM is much more convenient than depositing with a teller, most convenient of all is using your smartphone to do it. Most banks today have smartphone apps that allow you to securely and easily deposit a check from the comfort of your own home. No more lines. No more even having to drive to find an ATM.

Here’s how to use your phone to deposit a check:

1. Endorse your check.

2. Use the app to take a picture of both the front and back of the check you’re depositing. Follow the app’s instructions on how to deposit a check. Most will have you snap a picture of both the front and back of your check.

3. Shred the check after it clears. You’ll get a notification from the bank via your app or email that the check you deposited has cleared. Once you get that notification, shred and throw away the check.

The only downside of mobile depositing is that banks often put limits on the amount you can deposit with this method. So if you get a $30,000 check from Daddy Warbucks, you’ll need to make a visit to your local bank branch and deposit it with a teller.

Check Cashing Etiquette

Believe it or not, there is an etiquette to check cashing, and its only rule is to cash the check as soon as you can, especially if it’s a personal check. Here’s why: When your Aunt Gertrude wrote you that birthday check for $20, she probably deducted that amount from her check registry. If you wait a month to cash that check like the ingrate you are, poor Aunt Gerty’s checking account won’t balance. So help an ever-loving spinster out by depositing that check as soon as you get it.

Even if the check is from some faceless corporation, it will serve you well to cash it as soon as you get it. Many companies put expiration dates of 90 days on their checks, meaning if you try to deposit a check four months after you received it, you’re out of luck. Also, some banks won’t even accept checks that are more than six months old.

Make it a habit of depositing checks as soon as you get them. Do it now!

What If You Need the Cash Fast and Don’t Have a Bank Account?

Okay, let’s say you don’t have a bank account, you need cash fast, and you just received that $20 check from Aunt Gertrude. You can get access to that money by cashing the check, but as we said above, it will cost you.

Simply go to any bank and cash it. You’ll have to pay a fee, provide a photo ID, and they may even ask for your fingerprint. They’ll also bug you to open up an account with them. You should.

Other places you can cash checks are grocery and convenience stores like 7-Eleven and Walmart. They’ll charge a small service fee (Walmart’s is $3 per check) and will ask for ID.

Don’t spend all your Christmas money in one place. And don’t forget to send Aunt Gerty a thank you note.