Featured///

Podcast #980: Walden on Wheels — A Man, a Debt, and an American Adventure

What to Do If You Get a Sudden Financial Windfall

Podcast #963: Launch a Million-Dollar Business This Weekend

The Secret World of Bare-Knuckle Boxing

Why Your Memory Seems Bad (It’s Not Just Age)

Grid-Down Medicine — A Guide for When Help Is NOT on the Way

The Power of Everyday Rituals to Shape and Enhance Our Lives

The Latest///

Podcast #980: Walden on Wheels — A Man, a Debt, and an American Adventure

Millions of young adults know what it's like to graduate from college with student debt. For some, it's a ...

Full article

What to Do If You Get a Sudden Financial Windfall

A loved one dies, and you receive a substantial inheritance. You sell your business for a hefty price. ...

Full article

Podcast #963: Launch a Million-Dollar Business This Weekend

Have you always wanted to be an entrepreneur but don’t have an idea for a business? Or have you been ...

Full article

Podcast #942: 10 Unchanging Ideas for Navigating an Ever-Changing World

To figure out what will happen in the future, we typically make guesswork predictions and look to ...

Full article

Look for Financial Big Wins

Over the past decade, my homeowner's insurance has slowly increased in price. It was never enough to ...

Full article

How to Handle Yourself at an Auction

If you're considering attending your first auction, you're in for an experience. Auctions are not only a ...

Full article

The Sometimes, Always, Never Rule For What to Carry In Your Wallet

Your wallet is an essential part of your EDC. It carries your identification and your means of payment. In ...

Full article

Podcast #836: Data-Backed Answers to Personal Finance Controversies

Dip your toes into the world of personal finance and you can find plenty of questions which are the ...

Full article

Podcast #659: Do You Want to Be Rich or Wealthy? (And Why the Difference Matters)

When we think about finance, we typically think about numbers and math. My guest today, however, ...

Full article

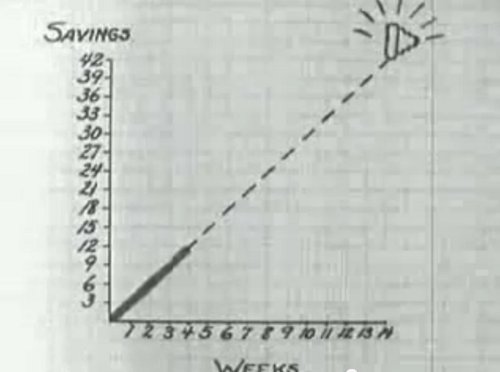

Why and How to Start an Emergency Fund

Why do you need an emergency fund? Because sh** happens and it can be expensive. Kids end up in the ...

Full article

11 Personal Finance Goals for Your 20s

With our archives now 3,500+ articles deep, we’ve decided to republish a classic piece each Friday to ...

Full article

8 Personal Finance Lessons from Benjamin Franklin

With our archives now 3,500+ articles deep, we’ve decided to republish a classic piece each Friday to ...

Full article

Podcast #605: The Money Moves You Should Make Right Now

The shutdowns that have accompanied the COVID-19 pandemic have wreaked havoc on the global economy. ...

Full article

Read These 5 Books to Get the Personal Finance Education You Never Had

During your school years, you learn reading, writing, and arithmetic; history, philosophy, algebra; a ...

Full article

Podcast #536: How to Achieve a “Rich Life” With Your Finances

If you've read a lot of personal finance advice, you know that it usually concentrates on what ...

Full article

How to Create a Budget

This article series is now available as a professionally formatted, distraction free paperback or ebook to ...

Full article

Podcast #529: The Money Scripts That Are Holding Back Your Financial Future

If you struggle with getting your financial house in order, you may feel that what you need is more ...

Full article

Podcast #511: Mastering the Psychology of Investing

When it comes to investing, your brain can be your best friend or your worst enemy. My guest today ...

Full article

Podcast #481: Building Financial Independence Beyond the Stock Market

Financial independence is a goal for a lot of folks. But what does it take to get there? My guest today ...

Full article

5 Reasons a Man Should Still Carry Cash

Cash is no longer king. According to a U.S. Bank survey conducted last year, half of people only carry ...

Full article