The manliness of frugality cannot be overstated. Frugality cultivates the manly qualities of independence, self-reliance, self-sufficiency, simplicity, and minimalism. It keeps a man free from the enslaving chains of debt and gives him an sense of manly pride and satisfaction. Frugality build a man’s immunity to the siren call of “stuff,” helps him learn to make do with less, and adds pleasure and happiness to his life by providing opportunities to practice delayed gratification. Frugality also fosters the DIY spirit and inspires a man to create, instead of consume.

We could wax long and poetic about the manliness of frugality but let’s get down to the brass tacks: how does a man become frugal? Some men, inspired to jump on the frugality wagon, set a drastic course for themselves and turn theirs live inside out. But inevitably, this man ends up chafing at the extreme constrictions he has set for himself, burns out on the program, and sets off on a shopping spree to compensate for the months of rigid restraint. No, the better course is simply to make little changes throughout the different areas of your life. You will be surprised to see how fast these small changes can add up and leave you with extra moola in your pockets and in the bank. And you also might be surprised to find out how fun being frugal is–really! It becomes like a game where you’re always trying to figure out ways to cut costs.

We’ve created this list of 80 practical–and often pretty painless–ways to save money. Whether you’re looking to trim your debt, live more simply, start an emergency fund, or just need to find ways to offset the hole in your budget created by rising gas prices, there are guaranteed to be a few things here you can start implementing in your life right away. I recommend giving these ideas a look-0ver, making a list of ten of more things you can give a go, and putting them into practice as a new month begins.

Victory over debt is at hand!

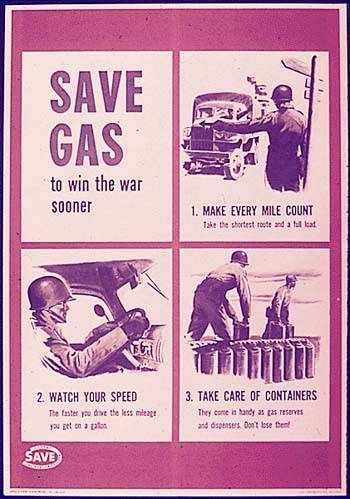

Automobile/Travel

2. Rotate your tires regularly. Tires are expensive. Make them last longer by rotating them regularly.

3. Buy your car used. And make sure you learn how to negotiate for one.

4. If you’re married and without kids, share a car with your wife. Kate and I have been sharing just one car since we’ve been married. Yeah, it can be a pain planning our schedules occasionally, but overall the experience hasn’t been bad at all and has become our normal. We’ve saved money on gas, maintenance, and insurance and the rides together provide us with time to talk and catch up with each other.

5. Pay auto insurance annually, instead of every six months. There’s usually a nice discount if you do this. Other ways to score discounts with car insurance include maintaining a safe driving record, shopping around for the best price, and staying with the same insurance company for an extended period of time.

6. Carpool. Dagwood does it. So can you.

7. Keep your tires properly inflated. Not only do properly inflated tires save you money on gas, they also cut down on tire wear and improve the handling and thus safety of your car.

8. Replace your car’s air filter regularly. It’s an easy car maintenance job you can do yourself, and it can save you money on gas.

9. Practice hypermiling. Hypermiling consists of using certain driving techniques to maximize your fuel efficiency. You do things like coast down hills in neutral and turn off your car when at a stop light.

10. Don’t speed. You use more gas when you do and you risk getting a costly ticket.

11. Plan trips where you have friends and family. During Kate and I’s poor college student days, this is how we were able to go on vacations. We’d hang out with Uncle Buzz in Vermont or go see Kate’s grandparents in Orlando.

12. Always negotiate for hotel rooms. Hotel rooms are like highly perishable food: if they’re not used that day, they’re wasted. You can almost always get a better deal just by asking. Anytime Kate and I are traveling by car and we’re ready to call it a day, we’ll Google nearby hotels on our phone as we approach the town we’re driving into and ask for their rates. Then we’ll start a bidding war between the different hotels: “Is that the absolute best price you can do? La Quinta has a room for $45 a night. Any chance you can go lower than that?” Using this tactic we had one hotel room go from $125 to $40. Boom.

13. When flying, bring your own snacks.

14. Skip on car rental insurance. Check your personal car insurance plan to see if they cover you for rental cars, too. Many plans do. Also, the credit card you use to rent the car probably offers rental insurance. (Learn more about renting a car without having an aneurism.)

15. Travel after peak season. It might be hard if you have kids in school, but you can find some good deals on hotel rooms and flights if you travel during the off-season and time your trip for the middle of the week instead of on the weekend.

16. Camp. Kate and I went camping last week. Spent just $10 for the campground fee and $20 for food and supplies. But it felt like a true getaway. Just spending a day and a night in the outdoors completely refreshed us.

Dressing and Grooming

17. Shave with a safety razor. No more buying $20 multi-blade razors.

18. Better yet, shave with a straight razor. No more having to buy razors at all, for the rest of your life!

19. Best of all, grow a beard. No razors and no shaving cream either.

20. Extend the life of your safety razors by keeping them dry and stropping them on your arm. Dull blades are the result of imperfections in your blade. Water causes your blades to corrode, and consequently creates imperfections. So keep your blades dry. But a neat little hack to sharpen those blades up is to do to your disposable razors what you do with your straight razor: hone them. If you don’t have a leather strop handy, just use your forearm. Rub your razor on your forearm in the non-cutting direction for about 10 strokes. Disposable razor stropped and ready to go.

21. Wash and iron your own dress shirts. Even if your local dry cleaner charges the very inexpensive rate of $1 per shirt, at 20 shirts per month, you’re looking at spending $240 per year. This amount can easily balloon to $1000 if you’re paying anywhere near $4 to $6 a shirt. You can complete this easy chore yourself in just 15 minutes a week.

22. Get your current wardrobe altered if you lose/gain weight instead of buying a new wardrobe.

23. Buy your clothing at a thrift store.

24. Cut your own hair. I’m a big advocate of the barber shop, but many barbers are charging $15-$25 for a haircut these days. For me, what you get–a great haircut, a great experience, and the opportunity to take part in a manly tradition–makes going to the barber well worth the price. But if you’re really wanting to tighten the belt, give yourself a buzz cut.

Health and Fitness

25. Ditch the gym membership and create a DIY Gym. Also, rediscover the joy of the garage/basement weight set.

26. Bodyweight exercises. Check out our guide with 35+ different push-up exercises. We also have a burpee guide with different routines you can do, a pull-up guide, and an old-time strongman’s morning bodyweight routine.

27. High deductible insurance + health savings account. If you and your family are healthy, you might consider switching to a high deductible insurance plan and opening up a health savings account along with it. While you have to pay more out-of-pocket before coverage kicks in, the premium you pay each month can be considerably less than regular plans. The health savings account you open along with your high deductible plan allows you to set aside money tax free that you can only use for medical expenses. You use the money in your health savings account to pay co-pays, deductible expenses, and medications. The lower premiums of a high deductible plan plus the tax savings of an health savings account can mean big time health insurance savings.

28. Get samples from your doctors. Most docs are happy to fill a bag for you with a bunch of samples of the medication you need.

29. Take care of yourself. The healthier you are, the less likely it is that you’ll have to make visits to the doctor and spend money on medications. Exercise and eating right are simple things you can do to stay healthy and reduce medical costs. Also, take care of your teeth. Dental corrections like fillings and root canals can cost an arm and a leg. Invest three minutes of your day, morning and night, to proper dental hygiene.

30. Stop smoking. Last time I checked a carton of cigs was going for $20+. Besides the money you save by not buying a carton every week, you’ll also save money on health costs in the long run.

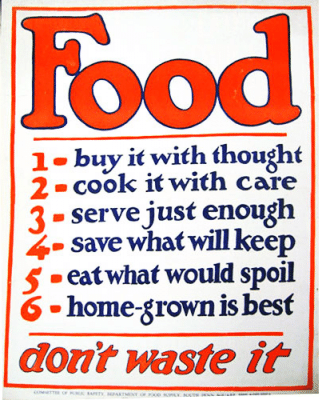

Food

31. Shop with a list. Studies show that when you shop with a list, you spend less than if you don’t, as it helps you concentrate on picking up only what you need.

32. Brown bag your lunch. It’s not only cheaper, it’s usually a heck of a lot more healthy than going out to a restaurant.

33. Cut back on packaged and convenience foods and learn how to make cheap meals yourself. Pasta. Beans. Eat them.

34. Make leftover-friendly food. Casseroles and crock pots are your best friends here.

35. Make your own coffee. Time to break-up with your favorite barista.

36. Drink more water. Water is free, and it’s good for you. Drink it instead of flavored beverages that cost money and pad your waistline.

37. Limit going out to eat to one time a week or less. And when you do go out, split America’s massively-sized portions in half and use a coupon.

38. Grow your own vegetables. Can’t do this right now because we live in apartment, but it’s a future goal. I have friend who has had tremendous success with growing his own vegetables. He saves money, and he says it makes him feel like a homesteader.

38. Grow your own vegetables. Can’t do this right now because we live in apartment, but it’s a future goal. I have friend who has had tremendous success with growing his own vegetables. He saves money, and he says it makes him feel like a homesteader.

39. Buy store brands. Here’s a secret that brand name companies don’t want you to know: sometimes generic brands are made at the very same factory as the brand name product, they just put a different label on it. Sometimes this isn’t the case, and the generic really is inferior in quality. So just do some experimenting to see what works.

Be sure to listen to our podcast on the philosophy of frugality:

40. Have a weekly menu. I don’t know about you guys, but when Kate and I don’t have a menu planned out, when the question of “What are we going to eat tonight” rolls around, it’s pretty easy to respond with “Let’s go out.” A weekly menu can help you reduce the amount of times you go out to eat, thus saving you money on expensive restaurant food.

Entertainment

41. Cut the cable. Farewell Snooki.

42. Board games and the like. Boggle. I love Boggle.

43. Matinee and dollar movies. Movie theater experience without the movie theater prices. And in the case of matinees, without the interrupting teenagers.

44. Take advantage of your local college or university. Colleges often have free cultural events and lectures that are open to the public.

45. Trade and borrow with friends. If you need tools or other items to do a job around the house, instead of going out and buying them, check with your friends or neighbors to see if they have it and if you can borrow it. You can also do this with books, CDs, movies, and video games.

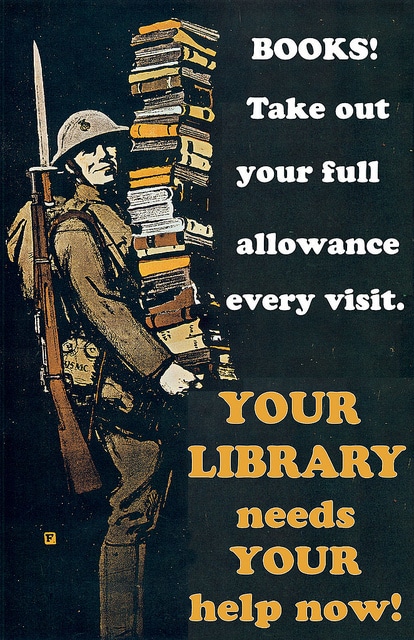

46. Use the library. Kate and I are total library hounds. We use it to score not only free books, but current CDs and DVDs as well. If you haven’t used the library in awhile, you really need to give it a try. With the Tulsa library system, you can look up a book online and no matter what library it is at in the city, you can request that it be delivered to the library closest to you. A few days letter, you saunter into the library down the road, and the books, CDs, and movies you wanted are waiting for you on the reserve shelf. It’s magical really.

47. Feed your mind online. The public library is not the only place you can get free mind-expanding materials. From university lectures from the country’s best professors to engrossing TED talks to classic books in the public domain, you can find enough free brain food on the internet to keep you occupied from here to eternity.

48. Keep an eye on subscription services. Netflix, magazine, and online subscriptions can add up fast if you’re not careful. Do a subscription audit to see if you’re using the service enough to warrant the cost and if you can find free alternatives to your current subscriptions. Did I mention the library?

49. Rethink your hobbies. Some hobbies cost a ton of money. Case in point: gun shooting. I’ve been getting into marksmanship and enjoy going to the range to pop off a few rounds with my Colt Python .357. But one of the things that surprised me about range shooting is how much ammo costs. Holy freaking cow! So I’m finding ways to make gun shooting cheaper, like practicing my dry firing at home. If you have a hobby that’s costing you a lot of money, find ways to make it cheaper. If you can’t do that, you might consider dropping it all together and finding a cheaper one, at least until your cash flow increases. Don’t know what to replace it with? Check out our list of manly hobbies.

Computer/Tech Stuff

50. Use free tools and software for all your computing needs. It’s amazing how many programs you can get these days that are completely free. Instead of forking over money for Microsoft Office, use OpenOffice or Google Docs. Wikipedia has a massive list of open source software that’s completely free. Check to see if there’s a free version of what you’re looking for before spending money.

51. Refill ink cartridges instead of buying new ones.

52. Print in draft mode. It uses less ink.

53. When you buy new computers or printers, keep the old cables. You never know when they’ll come in handy.

54. Buy refurbished. If you need a new computer, check the company’s website that you want to buy from to see if they have any deals on refurbished items. I know lots of Apple fanboys who can’t afford (or don’t want) to buy Apple products new, so they buy a gently used version of the product they’ve been lusting after.

Utilities

55. Regularly clean the coils on the back of your refrigerator. A clean coil uses less energy.

56. Keep your freezer full. An empty freezer requires more energy to keep cold. If you don’t have anything to put in your freezer, fill up milk jugs with water and pack them in your freezer to take up space.

57. Kill the electricity phantom. Whenever you leave a device plugged into a wall socket, it continues to constantly draw a small amount of energy. All those plugged in appliances can take a toll on your electric bill.

58. Seal energy leaks. Energy leaks in your house make your heater and A/C work harder to maintain the temperature of your home. And the harder your central heating and cooling systems have to work, the more money you have to spend. Spend a weekend finding and sealing any energy leaks.

59. If you have a cell phone, get rid of your land line.

60. Put on a sweater or open up a window. Heaters and air conditioners can use a lot of energy to keep your house warm or cool respectively. If you’re feeling chilly, put on a sweater before you turn up the thermostat. If you’re feeling warm, open up a window. Fresh air makes you feel a lot happier too.

61. Turn off the lights. It’s a not a big thing, but every little bit helps. Follow your mom’s advice. Turn the lights off when you leave a room.

62. Use compact fluorescent bulbs or LEDs. I include this suggestion rather begrudgingly. I’m not a fan of the light that CFLs or LEDs give off. It’s flat and reminds me of being in a hospital. Give me the warm glow of an incandescent bulb any day. But I can’t deny the energy savings of CFLs and LEDs. Although they cost a little more than regular bulbs, they last up to 10 times longer and use up to 75% less energy than incandescent bulbs.

63. Plant shade trees. According to the U.S. Forest Service, “Trees properly placed around buildings can reduce air conditioning needs by 30 percent and can save 20 — 50 percent in energy used for heating.” If you can, plant some trees on the side of the house that gets the most sun.

64. Install aerating, low-flow faucets and shower heads to limit your water usage.

65. Lower the Water Heating Temperature. For each 10 degree reduction in water temperature, you can save between 3%-5%. 120 degrees is probably hot enough for most homes.

66. Put an insulator around your water heater. If your water heater needs it, surround it with a water heater insulator. That move right there can save you around 4%-9% in water heating costs.

67. Winterize your home. Winterizing your home makes your place more energy efficient so you can keep your family warm and toasty in the cold weather months without breaking the bank on energy bills.

Gift Giving

68. Make your own gifts. Brew some beer, make a birdhouse, or create a secret book safe. Use your imagination and your craftsmanship.

69. Offer to give a service, like mowing someone’s lawn each week for the entire summer instead of buying stuff. You can also put together a coupon book for someone like your wife, with coupons redeemable for things like “one free back rub.”

The flylady.com has many more cheap and free gift ideas for men, women, and children.

Miscellaneous Advice

70. Buy quality. Sometimes we get a little guff for promoting top-dollar products like Saddleback bags. Isn’t buying such expensive things incompatible with frugality? No, actually. Frugality isn’t about being cheap. It’s about getting the best value, and sometimes that means paying more to save more. It’s important to think about things in terms of cost-per-use as opposed to total cost. Let’s say you buy a pair of cheap boots for $50, and they’re neither comfortable nor particularly good looking, and so you only wear them when you have to which is once a week before they wear out in three years. The cost-per-wear on the “cheap” boots is thus 32 cents. Now, let’s say you spend $350 on a pair of top-quality, truly well-made boots. They’re really handsome, and you wear them every chance you get, which is four times a week. And they last you 50 years (with maybe a re-soling here and there). The cost per wear on the “expensive” boots is 3 cents. 3 cents! So which is the more frugal choice? This is a truth your grandpa knew well and why he actually had stuff to pass down to you.

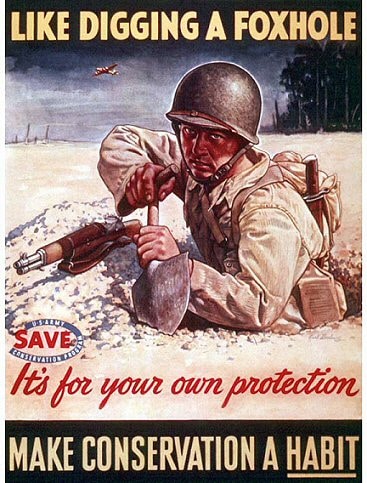

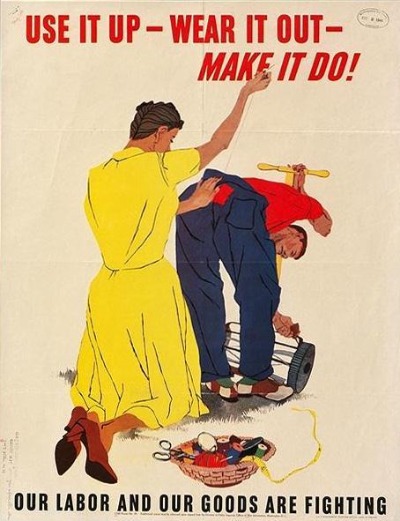

71. Use it up, wear it out, make it do, or do without. It’s a creed your grandpa and grandma lived by to get through the Great Depression, and it’s just as applicable today. I get a lot of satisfaction from trying to make my stuff last as long as possible. Particularly with clothes. Pants come open up at the seam? Sew them back up. T-shirts too ratty to wear in public? Turn them into dust rags.

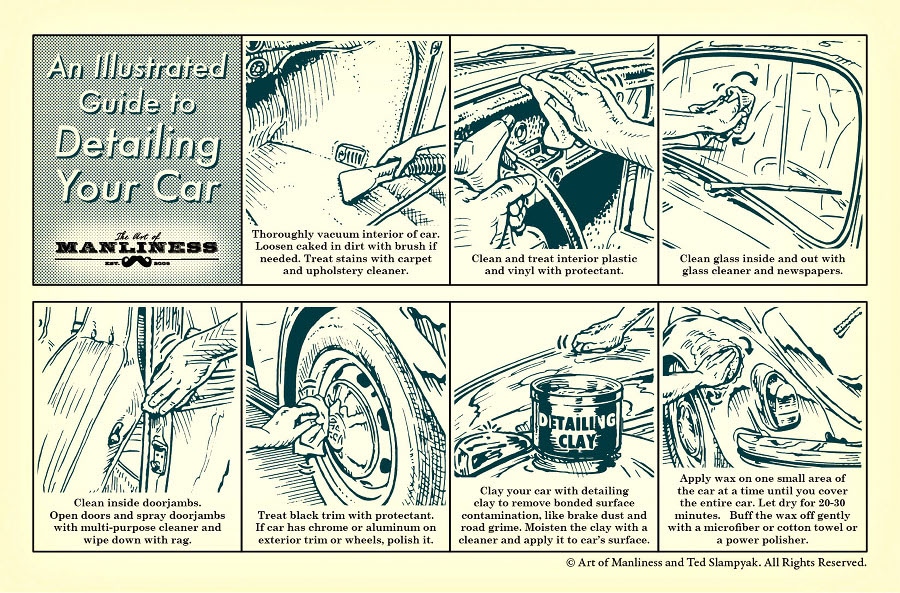

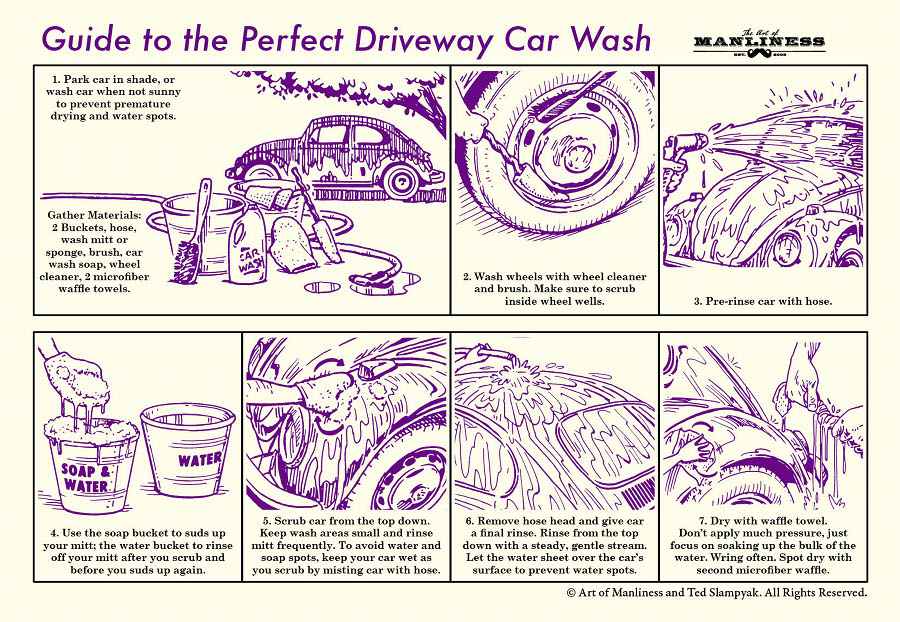

72. Foster a DIY mentality. Before spending money on hiring somebody to do a job for you, see if you can figure out how to do it yourself. When money’s tight, you can always use your other stash of equity: your time. Not only will doing things yourself save you money, but there’s a satisfaction and pride you get from being self-reliant. Of course, be careful with this advice. If it looks like it’s a job you can’t do or if screwing it up would cost you more money to fix, hire somebody to do it.

73. Be your own man. A big reason people spend money is social pressure. Don’t let others dictate how you’re going to live your life or spend your money.

74. Read up on personal finance. Knowledge is power. I subscribe to several personal finance blogs. Many of them post tips on thrift and frugality. My two favorites? Get Rich Slowly and The Simple Dollar. And I recommend checking these books out from the library: Your Money or Your Life by Joe Dominguez and Vicki Robin and The Total Money Makeover by Dave Ramsey.

75. Have a 30 day waiting period for big purchases. If you see something that you think you just have to have, before you hand over your credit card to buy it, put it on a “I’ll buy this in one month” list. If after one month you still think buying the item would be worth it, then get it. In my experience, after waiting a month you often realize you really don’t need it, so you save the money you would have spent. Score! And if you do end up getting it a month later, the power of delayed gratification makes the purchase more enjoyable than it would have been had you just bought it immediately. Score!

76. Use cash. In my experience, I tend to spend less when I use cash for most of my purchases. There’s just something about the tangibility of cash as opposed to debit cards that makes it hurt more to part with your money. When Kate and I were in hardcore debt repayment mode, we used the envelope budget system.

77. Learn to haggle.

78. Buy staples in bulk. Buying in bulk cuts down on the cost per usage. If there are items in your house that you use regularly, buy them in huge quantities. Diapers, baby wipes, trash bags, paper towels, soap, etc.

79. Don’t enroll in your bank’s overdraft protection program. At first blush, it might seem like a good idea; overdraft protection means that if you go to make a purchase with your debit card, and you don’t have enough money in your account to complete the transaction, the bank will “loan” you the money…and charge you a $25-$35 fee for their generosity. But that’s a big price to pay to avoid the embarrassment or inconvenience of having your card declined. And these fees can add up fast, because here’s what many consumers don’t know: most banks will purposefully process your largest transactions first, and then your smaller transactions after that. So let’s say you have $285 in your checking account and you buy a coffee for $3.50 in the morning, a sandwich for $5 at noon, and then some college textbooks in the afternoon for $300. The banks will process the $300 transaction first, thus depleting your account, and then charge you another $35 fee for the coffee and for the sandwich, and bill you for $105 in overdraft fees. Banks used to automatically enroll their customers in overdraft protection programs, but a court ruling last year made that illegal. But it was a big money maker for banks, so they still aggressively try to get you to sign up. Every time I check my bank account online, I get a pop up that asks if I’m sure I don’t want to enroll in their overdraft protection program. You just have to say no and keep saying no.

80. Avoid other fees. Businesses these days seems to be nickel and diming consumers any way they can with extra fees. Banks, airlines, and credit card companies are the big culprits. Be a responsible and savvy consumer and you can avoid most of these fees. Use ATMs in your bank’s network to avoid ATM fees and pay your bills on time, always. And fly Southwest! No extortionist baggage fees, friendly service, and one of the best safety records in the biz (recent holes in the plane notwithstanding).

Listen to our podcast on why you need a budget: