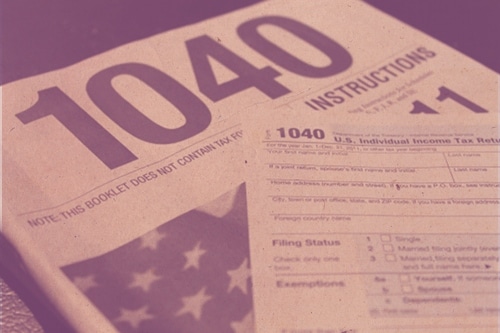

Growing up, I associated “doing your taxes” with being a grown man. Whenever tax season rolled around, I’d see my dad sitting at the dining room table on weekends, hunched over a coffee-stained 1040 instruction book made out of its distinctively cheap pulp, figuring out how much his and my mom’s adjusted gross income would be for the year. The charts, tables, and worksheets in the 1040 instruction book made figuring out your taxes seem like some sort of exercise in esoteric astrology that only the initiated could understand.

Being the dork that I was, I couldn’t wait until I could fill out my own taxes. Fast forward to high school and I got my first real job busing tables at Chili’s. The money was good, and I had my share of all the free Chicken Crispers I wanted. When tax season rolled around, I asked my dad if he could initiate me into the secret teachings of the 1040 form and accompanying instruction book. I remember going through the worksheets and filling out the different lines with pencil first, and then having my mom double check my calculations, just like dad did. When I signed my name at the bottom of the form declaring that the numbers I reported were correct, I felt like I was taking a step into manhood.

Yeah, totally geeky. I know.

I also remember thinking, “Doing your taxes is actually pretty easy. Why do people gripe about it so much?”

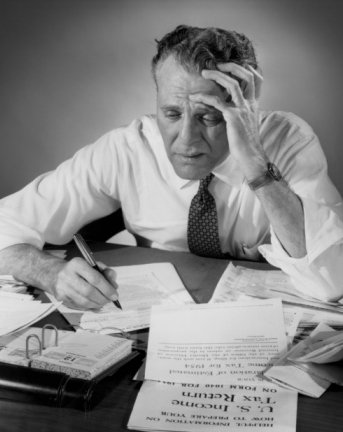

Well, now that I’m an adult with a home and other assets, I can understand why people gripe about filing taxes. They’re a pain. The more complicated your financial life gets, the more complicated your taxes become. Or as the late, great Notorious B.I.G stated so eloquently, “Mo Money, Mo Problems.”

I’ve completely lost the childhood mystique of “doing your taxes.” Luckily, when you’re young and just starting out in life, filing your taxes is simple. So simple, in fact, that there really isn’t an excuse for a young man not to take on this adult responsibility.

Yet in the past few years I’ve noticed a growing number of adult men whose dads still do their taxes for them. Seriously. I know guys in their late 20s and early 30s who’ve never filed their own taxes because their parents do it for them. Of course, this observation is completely anecdotal, but I’ve talked to other people about this, and they’ve seen the same thing: grown men who don’t know how to do their own taxes.

So to help those young men who have never filed their own income taxes before, I offer this beginner’s guide to help them ease into this responsibility. This post covers the bare essentials. The U.S. Tax Code is an amazingly complicated labyrinth of regulations. Tomes as thick as telephone books are written to help people navigate it. For the purpose of this post, I’m assuming you’re young, just starting your career and family, and make all your income from wages. We’ll save the intricacies of taxes on capital gains and losses for another day.

Before that day comes, perhaps both political parties will join hands and reform the tax code. And maybe one day I’ll don a pair of skinny jeans.

Basic Tax Lingo You Need to Know

Crap. I forgot how marginal tax rates work again.

One of the most intimidating things about doing your taxes is the tax jargon. Below I hit on some of the basic terms you’ll need to know to understand how income taxes work.

Witholding Allowances. You’ve probably noticed that when you get your paycheck you don’t actually get all the money you earned. Your employer subtracts, or withholds, taxes from your paycheck and pays the IRS the taxes you owe on your income.

You can control how much or how little your employer withholds from your paycheck using a Form W-4. A W-4 helps you determine your withholding allowances which tell your employer how much or how little money they should subtract from your paycheck for taxes. The more witholding allowances you have, the less income tax your employer withholds; fewer allowances and they withhold more. There are pros and cons for having more or less withholding exemptions. Maybe we’ll tackle them in a future post.

Adjusted gross income and taxable income.When you pay your taxes, you don’t actually pay taxes on the full amount you made during the year. Your adjusted gross income is your income after you subtract certain deductions like IRA contributions or payment on student loan interest. Taxable income is your income after you subtract the exemptions and itemized deductions (see below) that you’re eligible for from your adjusted gross income.

Tax bracket. In our graduated income tax system, the amount you pay in income taxes increases as you earn more money. The IRS has divided income levels into several income ranges called tax brackets. Tax rates are assigned to each bracket.

Here are the federal tax brackets for 2011:

| Tax Bracket | Married Filing Jointly | Single |

|---|---|---|

| 10% Bracket | $0 – $17,000 | $0 – $8,500 |

| 15% Bracket | $17,001 – $69,000 | $8,501 – $34,500 |

| 25% Bracket | $69,001 – $139,350 | $34,501 – $83,600 |

| 28% Bracket | $139,351 – $212,300 | $83,601 – $174,400 |

| 33% Bracket | $212,301 – $379,150 | $174,401 – $379,150 |

| 35% Bracket | Over $379,150 | Over $379,150 |

So, if you’re single and made $34,000 in 2011, you fall within the 15% tax bracket. All you need to do now is multiple .15 by $34,000 to get what you owe in taxes and then send a check for that amount to the IRS, right?

Well, no. There’s a catch. Not all of your $34,000 is taxed at that 15% rate. That 15% is what’s known in the business as your…

Marginal tax rate. I’ll be honest. It took me awhile to wrap my mind around the concept of the marginal tax rate. I always figured that if you fall in the 15% tax bracket, you pay 15% on all your income. It’s a common misconception that many people have.

A concise definition of your marginal tax rate is “the rate on the last dollar of income earned.” Okay, what does that mean? I think it’s easier to understand the marginal tax rate when you see it in action. Let’s again say you earned $34,000 in 2011 and are single. Here’s how the marginal tax rate would work:

- The first $8,500 of your $34,000 will be taxed at 10%.

- The remaining $25,500 will be taxed at 15%.

The last dollar(s) of income earned in this example is the $25,500 above and beyond the first $8,500 of income.

To solidify this concept, let’s look at another example. This time let’s say you’re filing jointly with your spouse, and have a combined income of $80,000. According to the chart above, the marginal tax rate is 25%. Here’s how your income would be taxed:

- The first $17,000 would be taxed at 10%.

- The next $51,999 would be taxed at 15% (the $51,999 figure is the difference between $69,000 and $17,001 in the 15% tax bracket range).

- The remaining $10,100 would be taxed at 25%.

In this example, most of your $80,000 is actually taxed at 10% and 15%, not 25%.

Don’t feel bad if you don’t get this concept right away. Marginal tax rates are pretty confusing and even really smart people mess it up all the time.

Effective tax rate. So now we know that the tax rate assigned to your bracket isn’t the rate you pay on all your income. Your effective tax rate is a weighted average of the different tax rates that apply to your income. For example, if your marginal tax rate is 25%, your weighted average, effective tax rate is about 14.5%.

Tax Exemptions. Uncle Sam doesn’t make you pay taxes on the full amount you earned during the year. The IRS provides three categories of tax breaks to individuals: exemptions, deductions, and tax credits. They all reduce your taxable income, but they do so in different ways.

A tax exemption is a specific amount you get to subtract from your taxable income automatically. There are two types of exemptions: personal and dependent.

- Personal exemptions. If you’re single, have no children, and your parents aren’t claiming you as a dependent on their tax forms, you can claim a personal exemption for yourself. For the 2011 tax season, a personal exemption will reduce your taxable income by $3,700. If you’re married and filling your taxes jointly with your wife, you can also claim a personal exemption for your wife, thus reducing your taxable income by another $3,700.

- Dependent exemptions. A dependent exemption is an exemption you can claim for each person you support financially. Usually this means your kiddos, but other family members can qualify too. You can deduct $3,700 for every dependent you claim on your taxes.

Not everyone gets to claim exemptions. Once you pass a certain income level, exemptions are phased out. For a single man, that limit is $166,800. If you’re married filing jointly, the limit jumps to $250,000.

Tax Deductions. Tax deductions are certain expenses you’ve had during the tax year that the government allows you to subtract from your taxable income. For example, the government allows people to deduct the amount they paid on student interest loans during the tax year.

There are two ways to take advantage of tax deductions. First, you can take the standard deduction which is a fixed amount determined by Congress that you can deduct from your taxable income. The standard deduction for single filers in 2011 is $5,800; for married filing jointly it’s $11,600.

The second tax deduction option is what’s called an itemized deduction. Instead of taking the fixed amount, with itemized deductions you list all the different “items” that are eligible for a deduction, add up the amount you spent on those items during the year, and deduct that amount from your taxable income. Eligible expenses you can deduct from your taxable income include, but aren’t limited to:

- State and local income taxes

- Property tax you pay on your home

- Interest paid on your home mortgage

- Donations to charities

- Out-of-pocket medical and dental expenses

- Job-search expenses

- Out-of-pocket work-related costs like computers and cellphones

- Home office costs

While itemizing your deduction is more complicated than taking the standard deduction, it has the potential of reducing your taxable income substantially more. If you plan on itemizing your deductions, you’ll need to keep a record of all your eligible expenses. We’ll talk a bit more about when you should take the standard deduction or when you should itemize your deductions in a bit.

Tax credits. Unlike tax exemptions and deductions that reduce your taxable income, tax credits are tax breaks that are subtracted directly from the tax you owe. There are several tax credits out there that you may qualify for such as the Hope Scholarship Credit, Child Tax Credit, and Earned Income Tax.

Tax refund. As money is withheld from your paycheck throughout the year, there’s a chance you’ve been paying the IRS more than what you owe in taxes. When this happens you’re entitled to a tax refund. It’s your money after all. You determine your refund amount by filling out your tax form. If you’re getting big tax refunds every year, you might consider adjusting your withholding allowances so you can keep more of that money throughout the year.

Getting Organized

“Organize your receipts,” they said. “It would make your taxes easier,” they said.

Probably the most annoying part of doing your taxes is organizing all the paperwork you need to complete the task. When you’re first starting out in life, the only tax documents you’ll need to keep track of are your W-2s and maybe the 1098-E form showing interest paid on student loans during the year. As you mature financially, the amount of paper you’ll have to keep track of will increase.

To keep all my tax forms in one place, on January 1st I label a plain manilla file folder with “McKay Taxes INSERT YEAR.” As different organizations start sending me tax statements at the end of January, I just put them in my folder. When my financial life was less complicated, I’d take my folder, along with the appropriate 1040 form, and do my taxes in February. Now that I use an accountant, I just drop the folder off at her office. Easy peasy, lemon squeezy.

Below is a quick list of the various tax documents and receipts you’ll want to have in your personal tax folder:

- W-2 from your employer

- 1099-MISC forms for self-employment income

- 1099-INT (interest) and 1099-DIV (dividends) forms

- 1099-B forms showing brokerage trades in stocks and bonds

- 1098-E showing interest paid on student loans

- 1098 showing interest paid on mortgage

- Documentation showing deductions like charitable contributions, medical expenses, and IRA contributions

The list isn’t exhaustive. If you plan on itemizing your deductions (see below), the amount of records you keep will increase.After you file your taxes with the IRS, make sure to print off a copy of your 1040 for your own records. Put it in the folder along with your other tax documents and hold onto it for at least three years. If you’re ever audited by the IRS (knock on wood), you’ll need to be able to show them your tax records.

Which Form Do You Need?

While using a computer program can make doing your taxes a breeze, I’d encourage you to at least try doing your taxes the old-fashioned way with pen and paper at least once. Flipping through the IRS’ instruction book to help you figure out your taxable income is a great way to become familiar with the basic rules and regulations of the tax code. Plus, there’s something about the tactile nature of pen, paper, and calculator that makes doing your taxes oh so “romantic.” Wear a green eyeshade for added effect. You can download all the forms from irs.gov or just swing by your local library; they should have a rack full of them.

There are three different kinds of personal tax forms to choose from: 1040EZ, 1040A, and 1040. They vary in length and complexity. Your goal is to pick the simplest form for your situation. When you do your taxes with tax software, the computer determines what form you should use based on the information you provide. When you do your taxes by hand, you have to figure out which form to fill out yourself. Here’s how to do it:

1040EZ. The 1040EZ form is the shortest and EZiest (see what they did there?) to fill out. You qualify to use the 1040EZ form if you meet the following requirements:

- Your total income is under $100,000

- Your interest income is under $1,500

- You have income only from wages, interest, unemployment compensation

- Your filing status is single or married filing jointly

- You do not have any adjustments to income

- You are claiming only the standard deduction

- You may claim the Earned Income Credit

- You are not claiming any other tax credits

Basically, if your income only came from wages and some bank interest, and you don’t have any income adjustments in the form of deductions, use the 1040EZ form. If you’re young, in college, or don’t own a home, this probably describes you.

What makes the 1040EZ form so stinking easy to use is that it lumps together your exemptions and standard deduction into one simple subtraction problem. If you’re single and your parents don’t claim you as a dependent, your lumped together exemptions and standard deduction nut is $9,500. If you’re married filing jointly, your exemption/standard deduction nut is $19,000.

1040A. As you add layers to your financial life, the lines on your tax form increase. If you’re starting to invest in an IRA or you’ve invested and made money in the stock market, you’ll need to upgrade from the 1040EZ to the 1040A form. Use the 1040A if you meet the following requirements:

- Your total income is under $100,000

- Any age, any filing status

- You have income from wages, interest, dividends, capital gain distributions, IRA or pension distributions, unemployment compensation, or Social Security benefits

- You can claim the following adjustments to income: penalty for early withdrawal of savings, IRA contributions, student loan interest, and jury duty pay given to your employer

- You can claim the following tax credits: child and dependent care credit, credit for the elderly and disabled, education credits, retirement savings contributions credit, child tax credit, and earned income credit

- You are only claiming the standard deduction

Most taxpayers qualify for the 1040A form. If you’re out of college, married with kids, you’ll probably need to use the 1040A form.1040. The 1040 form is for folks whose financial life has moved beyond just a single W-2 form and paying some student loan interest. If you’re making money from a side business or you have a mortgage, you’ll need to upgrade to the 1040 form. Use the 1040 form if you meet the following requirements:

- You have income of $100,000 or more

- You are itemizing your deductions (such as mortgage interest or charity)

- You have income from a rental, business, farm, S-corporation, partnership, or trust

- You have foreign wages, paid foreign taxes, or are claiming tax treaty benefits

- You sold stocks, bonds, mutual funds, or property

- You are claiming adjustments to income for educator expenses, tuition and fees, moving expenses, or health savings accounts

Deductions: Standard or Itemized?

Earlier, we discussed how tax deductions come in two forms: standard or itemized. The standard deduction is a fixed amount; itemized deductions are complicated, but could reduce your tax bill more than the standard deduction. You can only take your deduction one way or the other, so you have to choose between taking the standard deduction or itemizing your deductions.

Which option you choose depends on your unique financial situation. The general rule is if the total of your itemized expenses is greater than the standard deduction ($5,800 single, $11,600 married filing jointly), you should itemize your deductions. If the standard deduction is greater than your itemized expenses, you should take the standard deduction. Duh.

Most young people starting out in life don’t have enough tax deductible expenses to warrant itemizing their deductions. Stick with the standard deduction until you have a mortgage and are filling giant trash bags full of clothes and leaving them on your doorstep for Prevent Blindness. (Make sure to get a receipt!)