This article series is now available as a professionally formatted, distraction free paperback or ebook to read offline at your leisure.

We’ve talked before about how as men, we should strive to create more, and consume less. But less doesn’t mean nothing. Unless you’re Dick Proenneke, you’re going to spend most of your life as a consumer of goods and services like cars, clothes, healthcare, and even your education.

Never in human history have there been so many choices as to what to spend your money on. And never have marketing tactics to get you to buy those things been so sophisticated. Every time you swipe a store loyalty card, use your smart phone, log into Facebook, or surf the net, companies are mining this data, gathering information on your address, family size, education and income level, favorite books, movies, and hobbies, and history of purchasing behavior. This data is then fed into complex algorithms that craft ways to target you with ads and mailings pitched to your specific hopes, dreams, and insecurities. Corporations have you in their sights.

Now, I don’t want to paint too sinister a face on it – companies are simply offering products and services that people want – but to the degree that marketers track you, they are essentially “predators” on the hunt. They don’t want to eat you, certainly (you’re much more valuable alive!), they just want to burrow into your mind and get you to buy their stuff. They’ve got millions of dollars and sophisticated tools at their disposal, so the playing field is far from level, but as the “prey,” you can definitely put up a fight. You need to be educated and empowered, an informed savvy consumer who doesn’t buy mindlessly on impulse and end up with a house full of useless or non-functioning junk and a mountain of debt. The informed savvy consumer makes his purchases on his terms and does his homework to make sure he doesn’t get ripped off, receives the most bang for his buck, and only buys what he truly wants and needs.

1. Understand the Principle of Value vs. Price

A few years ago, we did a project where we asked AoM readers to write up “Lessons in Manliness” profiles on the ordinary men in our lives, describing how these mentors embodied manliness and inspired us.

Something that I remember really striking me at the time was how many of the profiles mentioned that the man in question always made purchases based on the quality of a product rather than simply its price. When making a purchasing decision, they looked for things that would last.

My grandfather was this kind of savvy consumer, and yours probably was (or is) too. He 1) Didn’t care about amassing a lot of possessions, but wanted the possessions he did have to do their job and bring him enjoyment, and 2) he understood that just because something was cheap, didn’t make it a bargain. To figure out the true value of something, he looked beyond the sticker price, to the price per use.

Gauging Price Per Use

Let’s start with the example of a leather briefcase. Bob shops on price and buys a nylon messenger bag for $50. Frank, however, buys a leather briefcase with a lifetime warranty for $500. They each use their respective bags 200 times a year. Bob’s cheap bag wears out after three years and he has to replace it. Frank’s leather bag lasts 50 years, and he hands it down to his grandson. In Bob’s case the price per use on his bag was about 8 cents (200 uses a year X 3 years divided into $50). For Frank, his cost per use is 5 cents, which will only go down as his grandson continues to use the bag. So ultimately, while Bob’s bag was initially a whole lot cheaper, in the long run Frank’s purchase will turn out to be the better deal.

Something that will also affect this equation is how often you use the product. As Darren pointed out in his truly excellent So You Want My Job interview on being the owner of an outdoors store, if someone tries to save money by buying equipment over the internet, and that equipment ends up not fitting right, it will sit in the garage gathering dust, and its cost per use will soar. If the same person had gone to their local mom and pop store, where a trained salesperson helped them pick out just the right item, one they used as much as possible and got years of enjoyment out of, the cost per use plummets, making the more expensive purchase the true bargain over time.

Another good example of this is buying a mattress — you’ll be spending a third of your life on it, so purchasing one that helps you get a deep sleep night after night is an incredible value, even if the mattress you choose is more expensive than a cheaper model that would have left you tossing and turning just to save a few bucks up front.

Generic Versus Brand Name

Of course, when determining price versus value, always look into what you’re getting for the higher price. It can equate to higher quality, but certainly not always. The high price might simply go to support a brand name, a celebrity endorsement, or a big advertising budget. This is why when it comes to buying generic items over brand name ones, you have to experiment to find out what the extra cost of the well-known brand is netting you. Some generic brands are actually made in the same factory as the brand name ones, while some are cheaper because of their inferior quality. Here are a few examples:

At the grocery store:

- Cheaper paper towels and toilet paper — you often end up having to use more sheets to get the job done. Doesn’t always pay to go cheap here.

- Garbage bags — lift a cheap packed-to-the-max bag out of the can and be prepared to watch the bottom fall out. You only want to experience this once.

- Store brand zip lock bags — more than adequate as they seal fine and in all probability will only be used once anyway.

- Sugar is sugar and salt is salt.

- Medicines — the FDA requires that the active ingredient in generic medicines be the same as brand name versions. So a generic headache medicine will work just as well as Tylenol.

In the hardware store:

- Paint brushes — buy the best you can. They will hold more paint, be easier to work with, and last you a long time. You never want to try to draw a fine bead of paint with a junky brush that has the bristles splayed in every direction.

- Paint — when you have to apply a second coat of paint because the first didn’t hide the original color, you’ll rue your decision to save a few bucks per gallon.

- Drill bits — cheap ones snap or quickly become dull, resulting in your schlepping back to Home Depot in order to finish drilling the last 3/8″ hole in your project. Alas, this is harder to realize now that almost all, if not all, drill bits come from China.

It’s hard to know whether a generic item will be as good as a brand name without trying it out. That works for garbage bags, but of course you don’t want to experiment and get burned when you’re buying a big ticket item. We’ll cover how to carefully make those higher-end purchases below.

Don’t Be Dazzled by Features

Marketing expert Martin Lindstrom says that while men believe they don’t let their feelings get in the way of their purchasing decisions, their shopping behavior is best defined as “emorational.” Women do make more emotional purchases than men in general, but men often disguise their emotional impulse to buy by concentrating on the practical features of a product. Men like to learn about something’s specs, and can rationalize that getting a more expensive product with a ton of features makes sense. In reality, it’s often the coolness of the product — the way he imagines owning it will make him feel — that is luring him. Paying a hundred dollars more for something with twelve features when you only need two isn’t a good value.

Of course when you’re first starting out in life, you often can’t afford the higher upfront costs of quality products, and you shouldn’t go into debt to get them. Try to make your cheaper products last as long as possible; don’t buy a replacement if it’s not broken, and try to fix it to extend its life. The longer you use it, the more time you’ll have to save up for a quality item that will last.

To sum up: instead of purchasing a lot of crap, a savvy consumers gets a few good things that will bring him a lifetime of utility and enjoyment.

2. Research, Research, Research

Before making any big purchase or contracting a service, a savvy consumer does as much research as they can. Your goal is to find out if the product will give you the most bang for your buck and will satisfy your demands for quality and safety. If you’re buying a product, just Google the name of it, as specifically as you can, plus “review.” If you’re buying an appliance, try hopping on Amazon or BestBuy and read the reviews there. For electronics, cnet.com is the place to go. You’ll need to use your discernment and have some patience with reviews offered by the public; up to 30% of the reviews may be fake — created by the company that makes the product or the guy who offers the service. Also keep in mind that people who were unhappy are more likely to leave a review than those who were pleased. I like to read a few reviews in the highest, lowest, and in-between categories and then kind of average them together in my mind to get an overall feel for how the product most likely really is.

There are also sites and publications that offer reviews for specific products. For example, Edmunds.com and Car and Driver are great for researching vehicle purchases.

It might even be worth it in some cases to pay for one month’s access to Consumer Reports online reviews. I’ve done this when buying things like computers and washers/dryers.

When shopping for a specific brand name item use Google Shopping to find the lowest price, then use Bizrate.com to check on the merchant’s reputation. It is not worth saving a few dollars if you end up hassling with a sleazy vendor.

If you’re researching a service provider, Angie’s List is the way to go. Look for someone who gets high marks on quality, reliability, and price. It also doesn’t hurt to ask your friends, family, and co-workers for recommendations too. In many cases, posing a question on Facebook to you local friends and family about reliable providers will net you better results than any search engine could.

3. Get Price Quotes from Several Businesses Before Making a Purchase

When it comes to hiring someone to perform a service, it really pays to shop around, as prices can vary widely. Again, a lower price may mean lower quality, while at the same time you don’t want to assume that if something is more expensive, it’s automatically better.

Getting multiple quotes allows you to make service providers compete against each other. If there’s a guy you want to use for various reasons, but another guy gives you a lower price, you can always go back to the first guy and say, “This is guy’s willing to do it for X, can you match that price?”

Yes, shopping around does take a bit of extra time, but it’s totally worth it if it means you can save hundreds or even thousands of dollars.

4. Learn How to Negotiate

For most young men in America, negotiating is a completely foreign concept. We’re socialized into thinking that you simply pay the price offered and that it’s rude to haggle. But if you want your dollar to go as far as it can, you need to learn how to negotiate. This skill can save you a ton of money over your lifetime. Is staying in your comfort zone really worth thousands of dollars that you basically threw out the window?

Some of your biggest purchases in your life will require you to negotiate — cars and homes being the most obvious. But even if you’re not in the market yet for these big ticket items, knowing how to negotiate can still serve you well. Everything from your car insurance rate to your gym membership is negotiable.

Last year, Tyler Tervooren wrote an amazingly comprehensive guide to haggling for us. I highly recommend giving it a read. Also, check out Getting to Yes — the book is crammed with tips on how to negotiate like a pro.

5. Ignore Up-Sales

When you walk into a store or even shop online, businesses want you to spend more money than you originally planned on. To encourage you to open your wallet, they use a technique called up-selling. Up-selling means suggesting upgrades, add-ons, and additional services to customers right before they pay for their original purchase. It’s amazingly effective when done right. Studies show that sales can increase by as much as 40% simply by implementing up-selling at the point of purchase.

You encounter up-selling all the time but may not have known what it was called. It’s especially common practice at restaurants. After she brings out your drinks, the waitress will probably say something like, “Would you gentlemen like to try to some of our amazing fried pickles as an appetizer?” You just got up-sold.

Whenever you shop on Amazon.com, you probably see a list of items that other customers bought who also bought the book you’re buying. That’s another example of up-selling.

Those types of up-sells are rather benign and can actually be useful. I can’t count the number of times I discovered a fantastic book thanks to Amazon’s suggestions. But you don’t want to be lured into buying something you don’t need or don’t have the money for.

The up-sells savvy consumers really need to watch for occur when you buy large appliances or computers.

Think back to the last time you bought a computer or some other expensive gizmo. You’ve got the product at the checkout counter and before the clerk rings you up he asks, “Would you like to buy an extended warranty? It’s only $25 and it will protect you even if you throw your laptop into a volcano as some sort of sacrifice.” As a general rule, a savvy consumer should decline the most extended warranty offers. You probably won’t need it; the manufacturer’s warranty is usually sufficient. Companies know the chances that you’ll actually use the warranty are slim, which is why they push them so hard. In fact, more than 80% of extended warranties go unused. So if a company can sell you one, it’s often pure profit for them.

Also, watch out for up-sells in the form of add-ons you really don’t need. For example, whenever you buy an HDTV, you’ll probably be told by the guy at BestBuy that you need to get some special $75 HDTV surge protector, as well as diamond, encased HDMI cables to ensure the best possible resolution. According to my brother, who once worked at Best Buy, you should always, always say no to this stuff. “They don’t do anything. The profit margins on them are high. That’s why we’re told to recommend them,” he says.

Bottom line: know exactly what you want before making a purchase, and don’t give in to high-pressure up-sells.

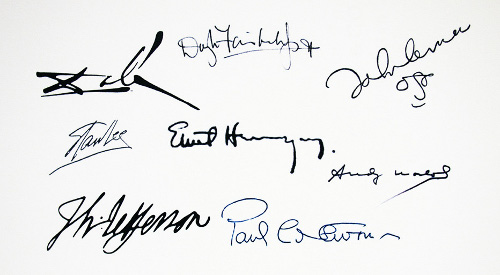

6. Read Contracts Before Signing

Renting an apartment, joining a gym, getting cell phone service, and purchasing health insurance are just a few of the services and products that require us to sign a contract. These agreements legally obligate you and the other party to fulfill certain terms. Failing to stick to your end of the contract can result in stiff penalties and possibly a lawsuit. That’s why it’s so important to take the time to thoroughly read a contract before you sign your name on the dotted line.

Unfortunately, many people don’t even bother to read contracts because they are long and sometimes overwhelming. While it’s a pain in the rear, get in the habit of reading all contracts before you sign them. If you have to, take it home and read it when you have more time. While you’re reading, look for the following things:

- How much and when will you pay?

- How long does the contract last?

- What are the penalties and consequences if one side doesn’t stick to the agreement?

- How does the contract end? Is there an auto-renewal? And if so, how can you stop it if you no longer want the service?

- What are the causes of terminating the contract?

- How are contract disputes resolved? Arbitration? Mediation? Courts?

- Are all the blanks filled in? Oftentimes contracts will have blank spaces where prices and dates are filled in. Make sure those spaces are filled in before signing so that someone can’t make any changes without your knowledge.

- Are all the oral and handshake agreements written in the contract?

Don’t be afraid to ask any questions. Also, if you find any terms that you don’t agree with, ask that they be changed. Before you sign, any of the terms in the contract are negotiable.

After you sign the contract, make sure you get copies of it for your records, which brings us to…

7. Keep Your Receipts, Agreements, Contracts, Etc.

Before you purchase something, you should always find out exactly what the store’s return policy is, and after your purchase, you need to hold onto your receipt. If you ever have a problem with a product or service and want to make a return or complaint, you’ll need it, along with any contracts you may have signed. So get in the habit of putting your receipts and agreements in a folder for safekeeping. Never again will you have to rummage through your car or random drawers looking for the receipt for your defunct TV.

Better yet, digitize all your receipts and contracts and store them in the cloud. I’m slowly making this a habit. I’m using the Evernote app on my iPhone to quickly snap photos of receipts and tagging them with “receipt.” I scan large documents like contracts directly into Evernote on my laptop. Now I don’t have to worry about misplacing receipts, and I have access to them anytime and anywhere.