The authors of The Bogleheads’ Guide to Investing (a book inspired by the sage investing principles of Jack Bogle) describe two mentalities when it comes to personal finance: the paycheck mentality and the net worth mentality. A person with a paycheck mentality just focuses on increasing their income in order to increase their wealth. A person with a net worth mentality also seeks to boost their income, but builds their wealth through saving and investing as well.

Pretty straightforward, right? The second path seems like the obvious tack to take. And yet many people are stuck in a paycheck mentality.

The problem, according to the authors, is that it’s easy to conflate income and wealth:

“From the time we are old enough to understand, society conditions us to confuse income with wealth. We believe that doctors, CEOs, professional athletes, and movie actors are rich because they earn high incomes. We judge the economic success of our friends, relatives, and colleagues at work by how much money they earn. Six- and seven-figure salaries are regarded as status symbols of wealth. Although there is a definite relationship between income and wealth, they are very separate and distinct economic measures. Income is how much money you earn in a given period of time. If you earn a million in a year and spend it all, you add nothing to your wealth. You’re just living lavishly. Those who focus only on net income as a measure of economic success are ignoring the most important measuring stick of financial independence. It’s not how much you make, it’s how much you keep.”

Before I read this, I understood the importance of saving money and living frugally, but I hadn’t really thought of income and wealth as distinct concepts. Consequently, I was more focused on increasing my income as opposed to increasing my net worth. I had a paycheck mentality.

After reading the above words of wisdom, and learning more about the best practices of personal finance, I started shifting to a net worth mentality. My primary goal now isn’t just to make more money, but to keep more of it so I can create long-lasting assets and security for myself and my family. Below is a guide to help you make your own shift from a paycheck mentality to a net worth mentality.

The Benefits of a Net Worth Mentality

The paycheck mentality is fragile; the net worth mentality is antifragile. Sure, life is great when you’ve got a steady income coming in. But what happens when that income stream dries up because you get laid off from your job? If you’ve been living paycheck to paycheck, you’re going to find yourself in a real pinch.

The paycheck mentality makes you fragile. Your financial security depends on your income, which is often something you don’t have complete control over, and can be taken away from you at any moment.

A net worth mentality, on the other hand, makes your finances much more robust. You have resources beyond your weekly paycheck, so that if setbacks occur, you can bounce back. And if you save and invest wisely, you’ll not only develop financial resilience, but financial antifragility; instead of merely getting by during times of stress, having money in the bank provides flexibility to take advantage of unforeseen opportunities or to pursue goals.

Wealth grows even when you’re not working. To increase your income you either have to 1) work more or 2) provide more value in some other way to your employer or client. Increasing your wealth, on the other hand, doesn’t necessarily require you to do either of those things. You can simply save more to increase your assets. And at a certain point in your wealth development, your money starts working for you instead of you having to work for it thanks to the power of compound interest. Your wealth will grow even when you’re sleeping or on vacation.

A two-pronged approach builds wealth faster. In the battle to become financially secure, concentrating solely on increasing your income represents a one-dimensional and less effective strategy. In working to boost your net worth as well, you attack debt on two fronts, and build wealth faster.

How to Calculate and Track Your Net Worth

Calculating your net worth is easy. Simply add up all the money you have as well as the value of assets like your home and vehicles, and then subtract your debt. Boom — there’s your net worth.

When it comes to determining the value of your assets, some people recommend including things like personal belongings such as your furniture, jewelry, and even your clothing. Personally, I don’t do that because I’m just lazy, but if you want a more accurate picture of your net worth, add those things in as well.

If you don’t want to go through the hassle of figuring out your net worth yourself, just connect all your financial accounts to Mint.com. You can connect all your savings and investment accounts (your assets), as well as your credit cards, student loans, and mortgage accounts (your liabilities). Mint makes tracking your net worth a breeze and generates an up-to-date chart of how it’s increasing or decreasing day-to-day and month-to-month. The goal, of course, is to see the line move in a generally upward trajectory.

How to Start Increasing Your Net Worth Today

Increasing your net worth is just a matter of paying off debt, saving more, and earning more. Simple in concept, but often hard to do. You really have to start playing the long game with your finances when you switch from a paycheck to a net worth mentality. Some months, you’ll barely see your net worth budge. You may even have periods when it decreases significantly. But if you keep working at it, you’ll slowly start seeing your net worth inch up.

Practice frugality. Spending less than you earn is the easiest way to increase your wealth. While you might not have much control over your income, you have significant control over how much you save. So maybe your boss can’t give you a raise this year — start saving more money by going out to eat less or buying fewer clothes.

According to the authors of The Bogleheads’ Guide to Investing, reducing your spending is not only easier, but also more efficient: “For every additional dollar of earnings you plan to save, you will likely have to earn $1.40 because you have to pay income taxes. However, every dollar you don’t spend is a dollar that can be invested.”

If you’re looking for ways to be more frugal, check out this post: Win the War on Debt: 80 Ways to Be Frugal and Save Money

Start an emergency fund. Focusing on a big, long-term goal like accumulating a million-dollar net worth can seem so daunting that you’ll just give up on even trying to grow your overall wealth at all. So break your ultimate goal into more manageable micro-goals.

Your first micro-goal towards building your wealth should be establishing an emergency fund. An emergency fund is money for those unexpected setbacks in life and their accompanying bills. Instead of taking on more debt by using your credit card to pay for these expenses, you can use cash from your emergency fund. And if you’re lucky enough not to have to dip into your fund? Well, you’ll be accruing interest (albeit small amounts) in your bank account, thus increasing your net worth.

I like the Dave Ramsey approach to starting an emergency fund. It’s what worked for us. Ramsey recommends creating a $1,000 emergency fund before you start paying down your debt. That way, you can use this small cushion for emergency expenses, instead of adding debt by using your credit card. You’d be surprised how easy it is to scrape together $1,000 in savings, even if your income is pretty marginal. When I was in law school, Kate and I were just barely getting by with our two part-time jobs, but we managed to save $1,000 in two months through a combination of cutting expenses and selling stuff on eBay and Amazon. In short, sacrifice and hustle.

Once you pay down your high-interest consumer debt, you can set the goal of having 3-6 months of basic living expenses in your emergency fund. At this point, the fund is designed to cover a fall into a variety of temporary financial straits, including losing your job.

For more information on creating an emergency fund, read this post: How and Why to Start an Emergency Fund

Pay down your debt. The easiest way to increase your net worth is to simply eliminate any debt from your balance sheets. Again, the beauty of focusing on paying off your debt is that your ability to do so isn’t entirely dependent on your income. You can always find ways to save a bit more and pay down that nut. When Kate and I were in aggressive debt demolishing mode, we pretty much ate spaghetti and cheap frozen pizzas for dinner every night. My breakfast and lunch was usually a peanut butter sandwich. We rarely went out to eat or bought new clothes. The money that we saved went directly to paying down our debt, and after a few years of sacrifice, we paid it all off and finally had a positive net worth.

I know for some of you, the idea of paying off your debt in a few years seems downright impossible. But it can be done. I know folks who had over six figures of credit card and student loan debt who paid it all off within five years without a six-figure salary. They just saved like crazy, found ways to earn extra money through side hustles, and funneled all that extra money into getting in the black.

What about your mortgage? If you have one, you don’t need to pay it off as fast as possible. But when you consider that, on average, your mortgage interest payments will tack an additional 100% or more to your loan value, it’s beneficial over the long run to pay less interest to the bank. You can cut your payments in half by following this bit of advice from the The Banker’s Secret: The next time you write your monthly mortgage check, write a second check for the principal-only portion of next month’s payment. In many cases, doing this can allow you to pay off a 30-year mortgage in 15 years.

For more information on paying down your debt, read this post: Start a Debt Reduction Plan

Start investing in index funds. Once you demolish your debt, start focusing on increasing your net worth through investing. When you’re investing for wealth, you want to think long-term. You’re not trying to make a quick buck through day-trading. Besides being super risky, that sort of “gambling” takes a lot of work and know-how. The average Joe with a day job and family simply doesn’t have time for that. That’s why I recommend that you focus on index funds for your investments. It’s what I do and it’s what several extremely wealthy and smart individuals recommend as well, like the Oracle of Omaha, Mr. Warren Buffet himself.

Index funds provide myriad benefits over traditional stocks and actively managed mutual funds. In fact, research shows that, over the long-haul, index funds outperform actively managed funds. Moreover, you keep more of your money because you pay less in fees and taxes. To compound the tax savings of index funds, hold them in a retirement account like a 401(k) or IRA.

For more information on index funds and retirement accounts, read these posts:

- Know-Nothing Investing: Index Funds for Beginners

- A Guide to Understanding 401ks

- A Guide to Understanding IRAs

Find ways to increase your immediate income. Thus far we’ve focused on the saving and investing part of creating wealth rather than on increasing your income. That’s because I really want to hit home the point that creating wealth isn’t just a matter of making a lot of money. I want you thinking net worth, not just paycheck. But increasing your income does have a role to play in boosting your net worth, of course.

The fastest and easiest way to increase your income is to ask for a raise from your employer. Lots of guys get sweaty palms just thinking about doing that, but it never hurts to try. Before you sidle into your boss’ office to ask for a paycheck enhancement, do your research and put together a solid case for how you add value to the company.

For more tips on asking for a raise, read this article: How to Ask for (and Get) a Raise like a Man

If it looks like you’ve peaked at your salary level with your current employer, then it’s time to start looking for another job.

And if you’re self-employed, consider raising your rates or increasing the number of clients you take on/products you make/services you offer.

In addition to finding ways to make more money with your day job, look for ways to increase your income by starting a side hustle. A side hustle is something you do to earn money during your spare time when you’re not on the clock at work. The sky’s the limit with side hustles. Just take inventory of your talents and figure out if they could be turned into a product or service for which people are willing to pay. For example, I speak Spanish fluently. So when I was in college, in addition to waiting tables, I also tutored fellow students in Español. All I did to create that side hustle was put up some flyers on bulletin boards around campus with my email address and my rate of $20 an hour. Within days I had several regular clients.

For more ideas on side hustles, check out these posts:

- The Company Man’s Guide to Starting a Side Hustle – Part I: Confronting Your Objections

- The Company Man’s Guide to Starting a Side Hustle — Part II: Think Big, Act Small

- Be Your Own Boss: 37 Side Hustle Ideas

Besides creating a side hustle, another way to increase your income is to sell your old crap on Amazon, Craigslist, eBay, or through an old-fashioned yard sale. Kate and I were able to significantly increase our cash flow by doing this.

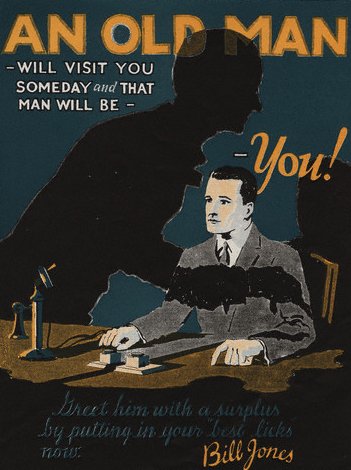

Shifting from a paycheck mentality to a net worth mentality is a shift from short-term to long-term thinking. Because the long-term future is so fuzzy and amorphous, it can be hard to plan your finances around something so abstract. But remember: One day an old man will visit you, and that old man will be you. By switching to a net worth mentality, you can be confident that the finances you leave him will be secure.

Further Resources on Graduating to a Net Worth Mentality